The Business Evolution of Glamping

Demand for the nature-based glamping experience is very much on the rise, and, despite the notable maturation of the market through investment and branded growth, particularly in the US, the sector remains underserved. Currently, far more demand exists than supply of either cabin/tent products or branded experiences. Travelers want more quality options across a variety of price points. Operators want more growth – whether entitled land or capital to go through the development process. And many landowners want to find glamping operators to help them capitalize on their land. With greater capital investment targeted towards land development opportunities, as well as product line development, supply may finally begin to catch up to the current levels of burgeoning demand.

From early Mongolian yurts to safari tents across Africa, ‘glamorous camping’ has come a long way over the last decade with offerings including cabins, pods, tents, treehouses, geodomes, wigwams and more, located all over the world. The worldwide glamping market was valued at over $2 billion USD in 2018 and is expected to grow more than 12% annually for the foreseeable future, reaching almost $5 billion by 2025. A rise in wellness travelers, estimated to represent 18% of all global tourism by 2022, combined with an increase in campers across the United States, half of whom are willing to try glamping on their next trip, has created the perfect environment for many players to enter the industry.

Demand for glamping was steadily increasing well before Covid-19, due to larger trends that include:

- the digital transformation of work leading to more freelance workers who live nomadic lifestyles

- an increasing demand for experiential travel, especially by millennial travelers

- a desire to “return to nature” both at home and on vacation

- a growing awareness for personal and environmental ‘wellness,’ and eco-consciousness

- the proliferation of social media, and the popularity of cabin and glamping type products online

- an increase in domestic travel

While Covid-19 has had a destructive impact on many traditional hospitality offerings such as hotels and restaurants, camping and glamping products have seen explosive demand due to their ability to provide socially distant, hygienic, and secluded breaks from the city. Outdoor spaces present a much lower risk than indoors in terms of transmission, and many Americans are trying to leave cities for some fresh air in any way they can. Unlike hotels and restaurants, which require heavy restructuring in order to remain Covid-friendly, social distancing is built in to many outdoor-based destinations, reducing the need for them to redesign their product or provide an experience that feels ‘less than normal.’ For hotel-wary travelers wanting a comfortable home base that is convenient for hiking, biking, and other low contact activities, glamping is the perfect solution.

With no front desk staff, common areas, no restaurant or bar, and secluded cabins or tents, operators like Getaway, HipCamp, Tentrr and others are perfectly positioned to capture this demand. For the glamping brands that do offer a higher level of service, EBITDA margins are still higher than hotel industry standards, reaching up to 50%.

PKF gathered compelling data that demonstrates this trend:

- Getaway observed a 400% increase in bookings when the Trump administration announced a Europe travel ban, and many outposts were close to sold out all summer.

- Collective Retreats bookings are up 10% in 2020 compared to the same week last year.

- The Dyrt, a camping trip planning website, has 400% more traffic in the summer of 2020 compared to 2019.

- Kampgrounds of America (KOA) reported that over the last year, 20% of their visitors are first-time campers with many of them choosing to ‘ease’ into the outdoors world via cabins and RV’s.

- Wyoming State Parks saw a 160% increase from April to May 2020 compared to the running average of the previous five years.

- Pennsylvania State Parks have seen over one million more visitors so far in 2020 than they did in all of 2019.

- RV Share, a motorhome rental site, has reported a 1,600% increase in bookings nationwide since April 1st.

- Based on summer 2020 demand, adventure travel is expected to continue to rebound quickly, while in comparison, Tourism Economics expects overall US travel market spending to recover to 2019 levels in 2024.

Business Models

Outside of the United States, glamping is still largely regional and singular; with only a couple of companies managing multiple locations such as PurePods in New Zealand and Unyoked in Australia. Many locations across the globe are not suitable for hotel products due to a variety of challenges including seasonality, accessibility, and zoning, but could be very well suited to glamping. Much of the global glamping market consists of independently run, ‘mom-and-pop’ operations that are then listed on various Online Travel Agencies (OTAs). The emerging glamping story in the United States is quite different, with many operators competing to capture the increasing demand at all ends of the service and budget spectrum. Many glamping operators have attracted significant institutional investment, demonstrating a clear proof of concept in a variety of business models. Market consolidation is occurring, and businesses in the space appear to operate either under a branded, more controlled operation (like a traditional hotel) or across an online network of multiple unbranded options, such as Hipcamp and Glamping.com.

Branded Operations

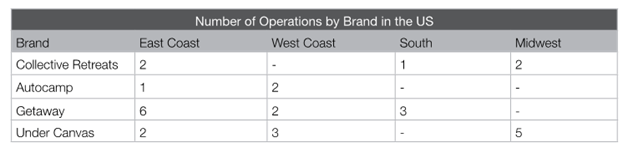

Particularly in the United States, there is a consolidation of the glamping market with branded operators offering a variety of alternative accommodation types from safari-inspired tents to Airstream trailers, a business model that is most similar to traditional hotels. Scaled and branded operators such as Getaway, Autocamp, Collective Retreats and Under Canvas typically own or lease their land and develop their units that range in service and positioning. Collective Retreats offers a more service-oriented stay, with dedicated in-house chefs and camp guides, while Getaway House outposts are designed to provide pure seclusion and relaxation without needing to interact with any staff.

Food and Beverage at these locations is always a consideration, and bathroom product can be a differentiator. Two notable tented operations have found that guests are willing to pay more - up to $80 more per night in some cases - for a private, modern bathroom over a simpler private bathroom or a highly-amenitized and well-designed shared bathhouse. F&B in some operations is very simple, with offerings such as gourmet meal packages available for purchase that can be eaten cold or cooked over a campfire. Some cabins have kitchenettes with stovetops and mini refrigerators for guests to be even more self-sustaining in their glamping choices and needs. In others, there is only bar and s’more service, and communal gatherings under an open-air tent or around a campfire are encouraged. Those operators seek locations for future projects that are both secluded enough to provide a camping-like experience and connected enough to local towns where F&B outlets are plentiful. At the higher end, where a full staff is deployed on-site, operators offer full-service F&B, and even event spaces that are fully catered.

Branded operators are a recognized player in the glamping space, and some hotels are catching up and using their existing brand awareness to expand product offerings into alternative outdoor accommodations. Marriott launched the first luxury tents at Coachella in 2017 and currently manages the Bintan Island Glamping Resort in Indonesia under their Tribute Portfolio. The Hoxton recently developed a pop-up, seasonal “glampsite” called Camp Hoxton in Oxfordshire, England, to attract those wanting to escape London for a city break, and has added additional tents due to explosive demand. Camp Hoxton is a co-branded partnership between Hoxton hotels and Eynsham Hall, a country manor hotel. Finally, Soho House’s Farmhouse operation, also in Oxfordshire, England, has been a great success for the membership club, causing it to increase small-cabin product on site and limit overnight stays to members-only due to very high demand. Soho House recently announced plans to break ground soon on a larger Farmhouse property in the tony Rhinebeck, NY of the Hudson Valley, with ample spa and F&B offerings.

Hotels are becoming increasingly tuned in to glamping trends, especially as they may have additional land and existing entitlements to allow for more units. Aman resort’s new Camp Sarika at Amangiri in Utah commands rates north of $5,000 a night, higher than the standard rooms at the hotel. Luxury Frontiers is a dedicated development and consulting firm that created Camp Sarika and has led numerous co-branded projects, adding luxury tents to existing hotel and resort operations across Africa, Asia and the US. Amidst limited wedding bookings and corporate events, hotels may turn to glamping products to make up for lost event revenue, and more hotel brands are planning to enter this space to capture both seasonal demand and the “unique-experience demand” that glamping fulfills.

Investment in the sector

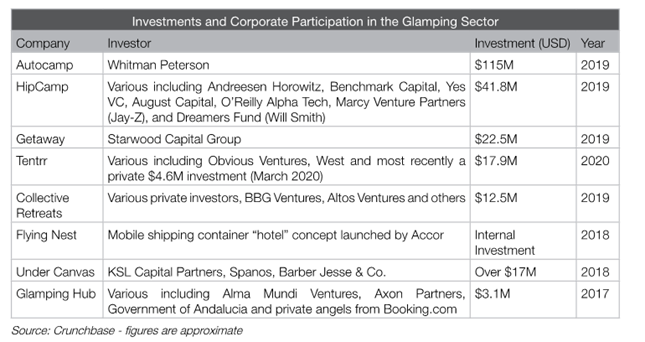

Future growth for branded operators cannot come fast enough. Before the height of the pandemic, one institutional investor described the glamping market around the New York market area as “infinite.” The EBITDA margins are high, the upfront development costs low, and the overall proposition is gaining traction among the investment community. The chart below highlights the institutional presence in the market since 2017.

The missing pieces for these brands’ growth is more accessible capital – including debt, which is extremely limited except in a small handful of cases – and land that is entitled for commercial/ hotel use. In too many cases of thwarted deals, beautiful land that is available for this type of branded operation confronts conflicts at the broader zoning level. By definition, this land tends to be located in smaller communities that often have vocal neighbors who fear the exposure that even 50 units will bring. This is a common problem in the hotel development industry. Glamping operations will continue to find solutions as investment capital and land-use efforts further recognize the need to support it.

Distributed Model - Dedicated Service Providers

A different approach to the “hotel model” of glamping is the unbranded, distributed network of online resources. Many existing online travel agencies such as Booking.com have attempted to capture demand by offering access to non-traditional accommodations such as treehouses or geodomes, but there has been a notable rise in OTAs that are specifically dedicated to glamping product. Glamping.com, GlampingHub, Canopy&Stars, Yonder, and others serve as marketing platforms that provide access to a wide variety of independently operated properties. Some sites, such as Canopy & Stars, offer strict quality control by thoroughly vetting all of their listed units. GlampingHub allows hosts to list for free, provides an in-house writer to create a custom listing, and collects a 4% commission on confirmed bookings.

HipCamp, often referred to as the ‘Airbnb of the outdoors’, provides a platform for landowners to rent out anything from a patch of grass on private property to a beautiful cabin in the woods. HipCamp supports landowners by offering liability insurance, business planning tools, and professional site photography. HipCamp leverages natural features to serve as demand drivers, while other organizations provide colorful guest experience. Farmstay US provides guests the opportunity to stay and experience small working farms and ranches; travelers can choose between harvesting food, milking cows, taking classes, collecting eggs, and much more. With an intent to expand the agritourism industry in America, the organization provides a wealth of resources to small farmers and ranchers interested in launching their own businesses and partners with Yonder to provide booking capabilities.

These OTAs and organizations allow landowners to gain more exposure than listing their offerings privately or with traditional vacation rental companies. All of these OTAs function as unique social media branding opportunities as well, with Instagram followers of several glamping OTAs and operators far outpacing many luxury hotels and traditional hospitality products, demonstrating widespread popularity and marketability.

Just as some hotel operators are strategically “asset-light” and do not own real estate, a newer and emerging land-host model applies that philosophy to glamping products. The land-host brand, or a third-party supplier, sells or leases units to land-hosts while units remain centrally marketed and profits are split between the two parties. The profit share percentage is dictated by the level of investment by the land-host ranging from about 45% to 80%. For landowners around the world that have access to attractive land and are looking to diversify their income streams, brands such as Tentrr in the US and Africamps in South Africa are able to provide them with product (tents largely) and marketing services.

Africamps offers a joint venture opportunity to farmers and landowners by financially investing in the development of a boutique glamping site on private property. This is done by providing fully furnished and installed ‘glamps’, offering landowners a turnkey business model while sharing revenues. The landowner arranges the permitting and utilities development of the land and Africamps then builds the product, performs marketing and sales, and pays the landowner monthly income from bookings. The landowner typically manages housekeeping and any other on-site services.Tentrr provides an avenue for landowners to ‘share land, earn income,’ by either listing plots of undeveloped land as ‘Tentrr Backcountry’ sites, or offering a turnkey safari-tent style model for purchase. Landowners can make an upfront investment of around $6,500-10,000 to purchase Tentrr Signature tents that provides landowners with a custom-built platform, a grade-A canvas tent, a queen bed, storage tables, outdoor furniture and more. Tentrr provides the campsite set-up and custom installation, as well as marketing, booking, insurance, and remote customer service to glampers. Tentrr Signature sites have average nightly rates upwards of $135 USD while Tentrr Backcountry sites average $35. Tentrr is the only major player to be delivering this model at scale, and it has grown in name-recognition and overall revenue and profitability since the start of Covid.

One day, when Covid is under control and the world returns to ‘normal’, travelers will arrive to hotels and resorts and exotic destinations in full force, but in the meantime, glamping has become a crucial pillar in the hospitality industry and is here to stay. Travelers that are looking to disconnect from increasingly technology-heavy lives and, more recently, physically constraining urban settings, want to return to nature and breathe a little more deeply. From an investment perspective, glamping offers a relatively low-risk and high-return proposition. We expect to see the industry continue to innovate and respond to this supply-demand imbalance in a myriad of ways.

Download the printable version

Written by Aalia Udawala and Channing Henry,

PKF hotelexperts, August 2020